PAWN LOANS

Bring your stuff. Make quick cash.

Need some quick cash? Get a pawn loan using an item of value to secure the loan. There are many great benefits to a pawn loan, including:

- Quick, easy, and confidential way to borrow money.

- A great alternative to traditional banks.

- No credit check or impact to your credit.

- Low-interest rate and storage fee.

- Items can be pawned again providing customers with cash whenever they need it.

Want to get started? Here’s how it works:

Getting a Pawn Loan

Bring stuff

Popular pawn items are jewelry, electronics, and tools. See the complete list of eligible pawn items.

Get an offer

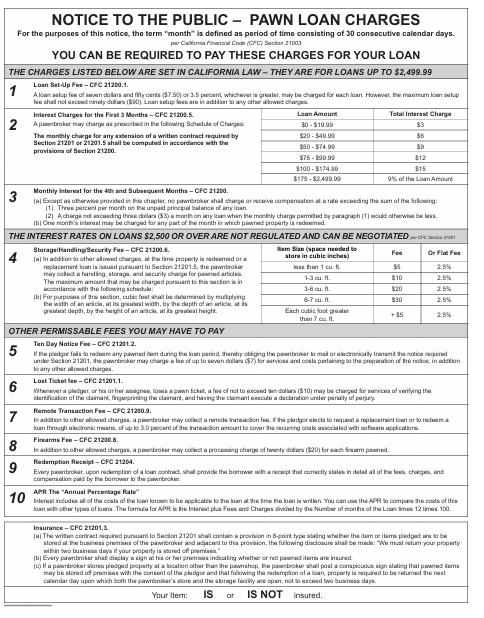

We’ll offer you a loan based on the market value of the item for 90 days. Market value is the current value the item could be sold for today (not the original price paid for the item). The loan will be a fixed state regulated interest rate

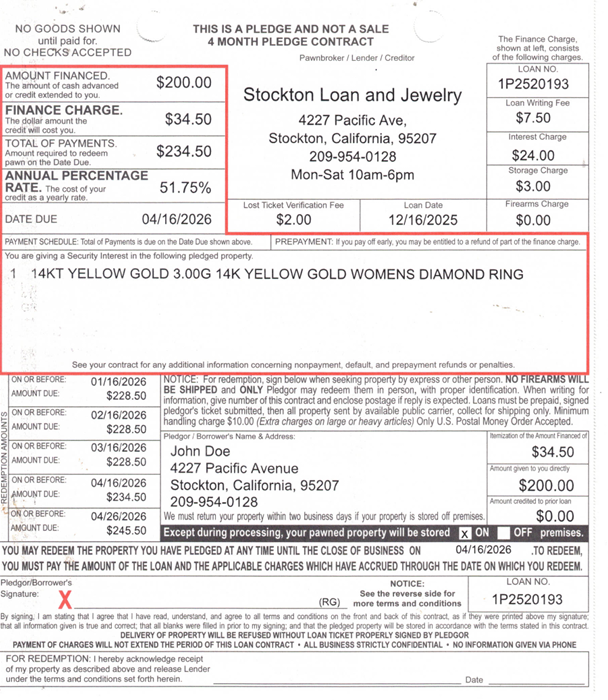

Keep your pawn ticket

Not only is it the receipt for your item, but it also summarizes the terms of your loan, including fees, item descriptions, and more. Here’s an idea: Snap a pic with your phone, so you know you have it.

Pawn with confidence

- Trust in our 25+ years of experience serving the community.

- Stockton Loan & Jewelry follows all federal, state, and local laws and regulations. Learn more.

- On average, more than 80% of all customers return to reclaim their items, according to the National Pawnbrokers Association.

REPAYING YOUR PAWN

Pay off & pick up your item

Extend your loan terms

- If you choose, you can simply pay the interest and roll the loan over for another 90 days.